If you are in dire need of a quick loan and you don’t opt for any banking service, then get a detailed guide about “How to Take Loan From Easypaisa”.

In times of dire financial need, microloans can be a lifesaver undoubtedly. Easypaisa is the leading digital payment platform operating in Pakistan currently. It offers an easy way to get quick loans without requesting through applications or credit checks. You can request a loan whether you need it for personal expenses or bill payments.

In this guide, we will take you through everything you need to know about How to take Easypaisa loan. We will also cover eligibility criteria, loan limits, codes, and step-by-step instructions for both app and USSD users, along with the repayment options as well.

So, let’s dive in!

Table of Contents

How to Take Easypaisa Loan

These are microloans and help users by giving them instant financial support. Usually, these are offered in smaller amounts and one has to repay it in a short period.

Easypaisa offers two main ways to apply for these loans. One is using its mobile app and the other one is via USSD code for those who don’t have a smartphone.

You can use these loans to pay your bills or manage unexpected expenses. Also, one doesn’t have to worry about repayment as it is also just as simple as applying.

But before getting into the actual ways of requesting an Easypaisa loan, it’s important for you to know about the loan limits, eligibility, plus the minimum and the maximum loan amount that one can request.

Easypaisa Loan Limit

The loan limit that you can apply for yourself depends on several factors. It includes your usage history with Easypaisa and your overall creditworthiness, which is actually determined by Easypaisa’s algorithms.

Here is a breakdown of the factors and a pro tip for you:

- Minimum Loan Amount: The minimum loan you can request is usually around Rs. 250/-.

- Maximum Loan Amount: Easypaisa may offer you a loan of up to Rs. 15,000/- depending on your transaction history and account status.

Pro Tip: Regular users having a good transaction history have a higher chance of getting higher loan limits. The more frequently you use it, there is a good chance of qualifying for a larger loan. Plus, the newly created Easypaisa account is not valid for applying for it.

Easypaisa Loan Eligibility

Before applying for a debt, you need to meet certain eligibility criteria. These conditions are mandatory to make sure whether the loan taker is eligible to repay it or not.

Below are the main eligibility requirements:

- Age: You must be at least 18 years old.

- Nationality: Only Pakistani citizens with a valid CNIC are eligible.

- Easypaisa Account: You must have a registered Easypaisa account that is regularly used. Make sure that your Easypaisa is not blocked. So, it’s mandatory to unblock the Easypaisa account first to apply for the debt.

- Transaction History: Easypaisa analyzes your transaction history to determine whether you are eligible for a loan or not. If you use Easypaisa frequently, it increases your chances of getting a loan.

Additionally, the network that you are using does not limit your eligibility because you can request an Easypaisa loan through the app or a USSD code.

How to Take Loan From Easypaisa

There are two primary methods to apply for an Easypaisa loan. Let’s explore both in detail.

Method 1 – Easypaisa Loan Apply Online (via App)

The Easypaisa app is the easiest and most direct way to apply for a loan. This online method is convenient for smartphone users as it allows you to apply for a loan from anywhere at any time without needing to visit an agent or dial a code.

Additionally, the repayment process can also be managed online via the app.

Here is how you can request it online via the app:

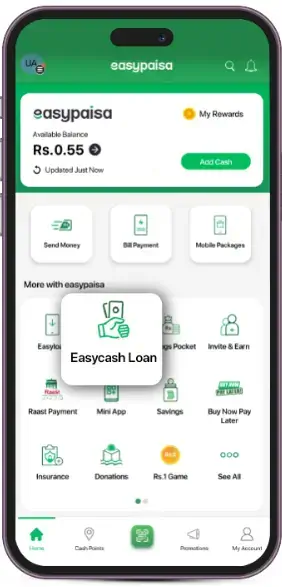

Open the Easypaisa App

- Open the installed Easypaisa app on your phone.

- Make sure your app is updated to the latest version.

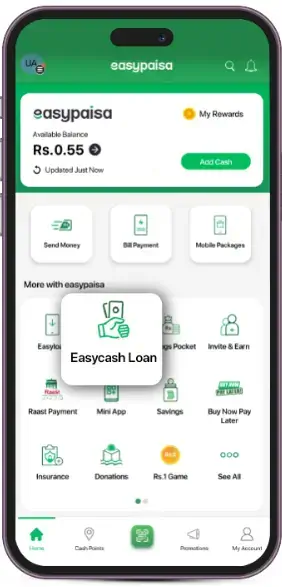

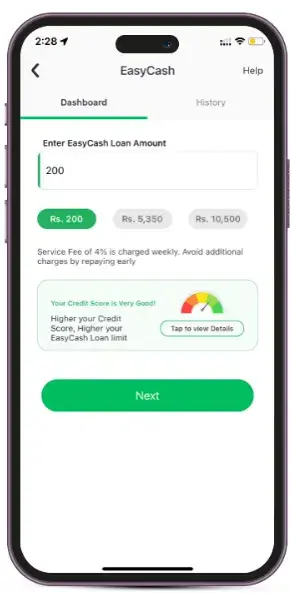

Navigate to the Loan Section

- In the app menu, locate the “EasyCash Loan” option.

- This is typically present on the homepage below the bill payment section.

Check Your Eligibility

- The app will automatically check your eligibility based on your transaction history.

Enter Required Information

- You may be prompted to provide additional details, like the amount you need.

Select Loan Amount

- Choose the loan amount from the available options.

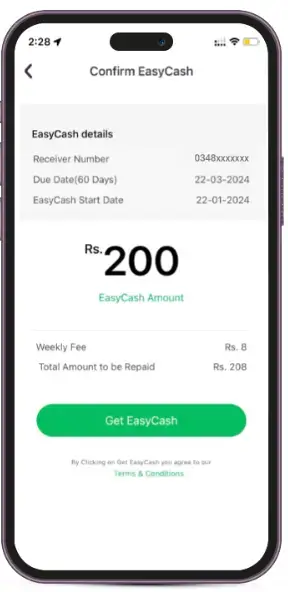

Confirm Your Application

- Double-check your details and confirm the loan request.

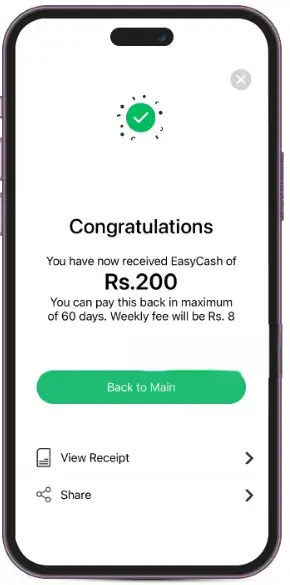

Loan Disbursement

- Once approved, the loan will be instantly credited to your Easypaisa wallet.

- Now, you can use it.

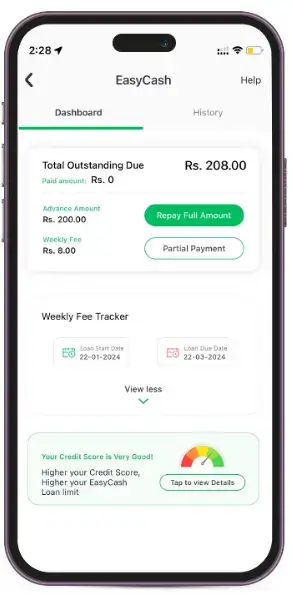

Repayment via Easypaisa App

Repaying your loan is just as simple. Follow these steps to make your repayment:

- Open the Easypaisa App.

- Go to the EasyCash Loan Section.

- You will see the loan history and repayment options too.

- Here, you have to select the amount to repay. You can either repay the entire loan or a partial amount.

- In the end, confirm the transaction and your loan will be repaid.

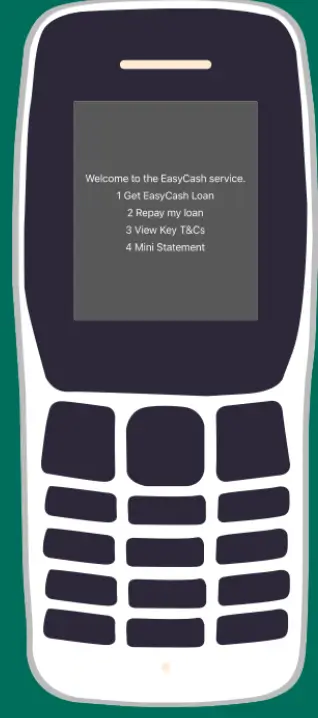

Method 2 – Via Easypaisa Loan Code

For users who don’t have smartphones or prefer the USSD method, Easypaisa offers an easy way to apply for loans through a code.

Dial the code Easypaisa Loan Code *786*7#

- Open the mobile dialer to dial the code *786*7#.

- This code works for all networks, including Jazz, Telenor, Zong, or Ufone. But if this doesn’t work for you, try dialing the code *2262#. You can also change Easypaisa account number if you have switched to another network provider.

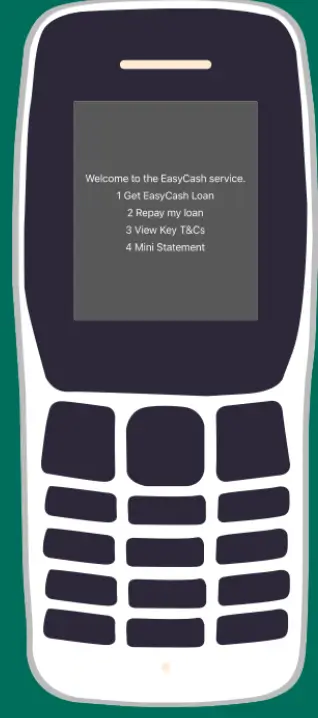

Follow the Prompts

- A menu will appear on your mobile screen where you will see several options for requesting a loan or repaying it and many more.

- Click 1 to apply for the EasyCash loan.

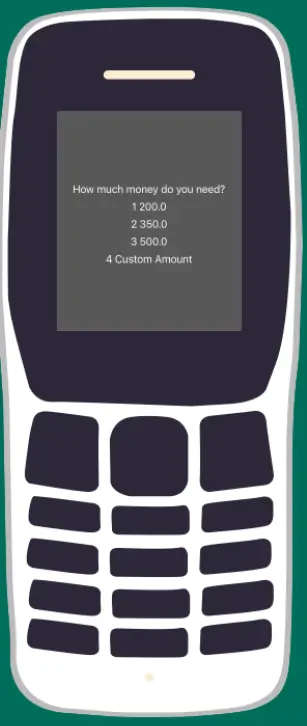

Select Loan Amount

- In the next step, you need to select the debt amount that you want to apply for.

- Choose from the available loan options based on your eligibility.

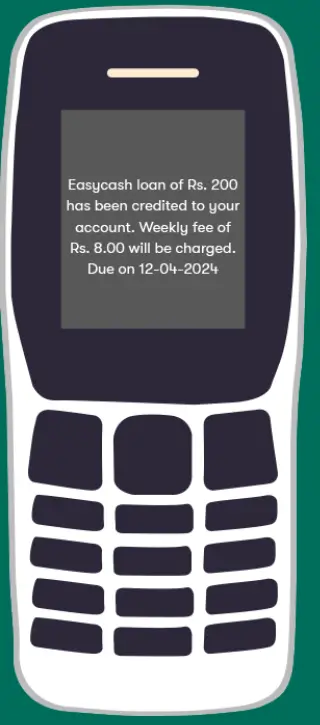

Confirm the Loan Application

- Once confirmed, your loan will be processed.

- A confirmation SMS will be sent to your number along with the due date and the weekly deductions.

Loan Disbursement

- To accept the loan terms and conditions, enter your Easypaisa PIN.

- It will be credited to your Easypaisa wallet instantly.

Repayment via USSD Code

You can also repay your loan via the USSD code:

- Open the mobile phone dialer to dial the code *786*7#. You will also use this code for the repayment option.

- Follow the menu to choose your loan repayment option.

- Mostly, the loan repayment option is option 2 from the menu. Select it to repay your loan.

- Enter the amount you want to repay.

- Your loan repayment will be processed, and you’ll receive a confirmation.

Regardless of the method you choose to take a loan, repaying it on time is crucial. Here’s what you need to know about its loan repayments:

- Easypaisa loans typically have short repayment cycles, ranging from 7 to 30 days.

- Be sure to repay your loan on time to avoid any late fees or penalties.

- You can repay through the Easypaisa app, USSD, or by visiting an Easypaisa agent.

Final Words

Easypaisa loans provide a fast and convenient solution to get immediate financial help. We have mentioned all the necessary information along with the valid and authentic loan request methods. You can take an Easypaisa loan using either of the two methods. Moreover, you can also visit a nearby customer care center of the franchise for one-on-one meetings.

But be sure to repay your loan on time to avoid any penalties and enjoy higher loan limits in the future.