Definitely, you know the usage and benefits of having an online wallet. That’s why you are here to learn about “How to Create JazzCash Account”.

JazzCash is a mobile wallet that helps in performing national and international transactions easily without the hassle of standing in long queues. Whether you are a new user or a regular one searching for some queries, we have organized this guide for your help. You can even use this to pay NetFlix or make international transactions through Payonner.

In this article, we will discuss the Jazzcash account creation online, with and without CNIC, and using different networks other than Jazz.

Table of Contents

How to Create JazzCash Account Without CNIC

If you want to create a JazzCash account without a CNIC, then it is not possible.

A valid CNIC is essential for most financial services and account creation. But there are scenarios where you might need an alternative approach.

If you don’t have a CNIC but urgently need a JazzCash account, you can create a temporary account by:

- Visit a Jazz franchise and provide your mobile number and other necessary details. The Jazz representative will guide you through the process.

- You will receive a temporary account number that is associated with your mobile number.

- You can use other valid IDs as an alternate in exceptional cases. These can be your passport numbers, driving license numbers, or other government-issued IDs.

You can now use this account but it has some transaction limitations. Still, you can use it for basic JazzCash services.

Upgrade to Full Account

Once you obtain your CNIC, it’s time to visit the Jazz franchise again.

- Provide your CNIC details for verification and the representative will upgrade your temporary account.

Now, you can enjoy higher transaction limits and additional services.

Family Accounts

If you are part of a family, you have the ease of creating a family account for you to manage family finances collectively.

- For this, one family member who has a valid CNIC can open his account and other family members can link their mobile numbers to this account.

Business Accounts

Entrepreneurs and small business owners can create business accounts by visiting a Jazz franchise or using the JazzCash app.

- For it, they need to provide their business details and CNIC in the relevant fields.

With a business account, you can do bulk payments, payroll management, and business expense tracking.

You can check with JazzCash customer support for specific guidelines.

How to Create JazzCash Account Online

If you are an eligible Pakistani citizen, then you can create a JazzCash account online using your CNIC by following these simple steps:

1. Download the JazzCash App

- Go to the Google Play Store to search for “JazzCash” and download the app.

- Install the app and open it.

2. Register Your Account

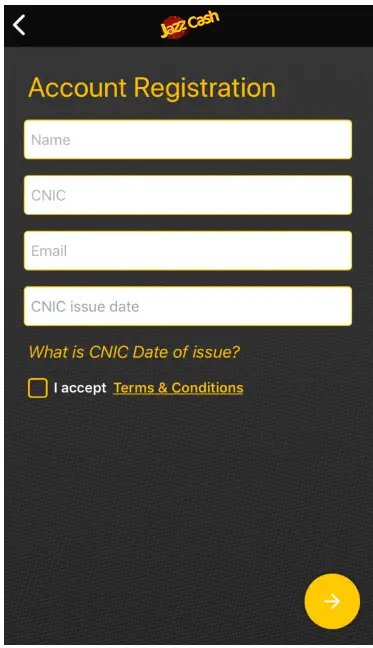

- After installation, open the app and click on “Register”.

- Follow the on-screen instructions after entering your mobile number.

- After that, enter your CNIC number, its issuance date, your name, and your email address to proceed further.

- Accept the terms and conditions and tap to proceed next.

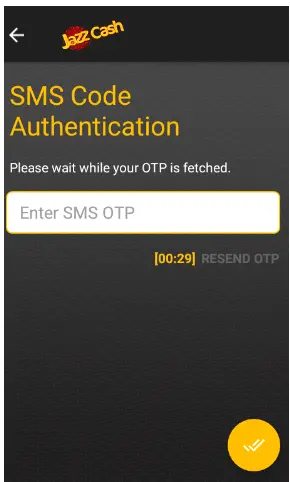

- You will receive an OTP (One-Time Password) on your mobile number. Enter it to verify your number and if you have your sim in the same device, then it will be automatically verified.

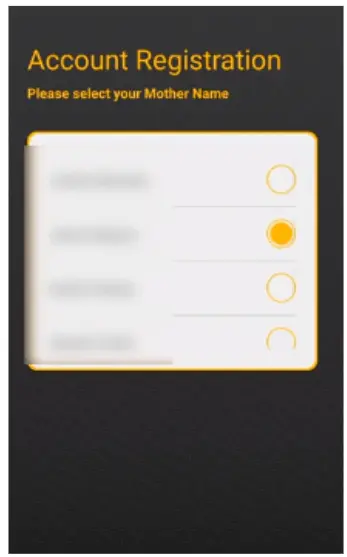

- Then, you will be asked to enter your mother’s name and select your birthplace from the given list. It must be the same as in the CNIC application and move to the next step.

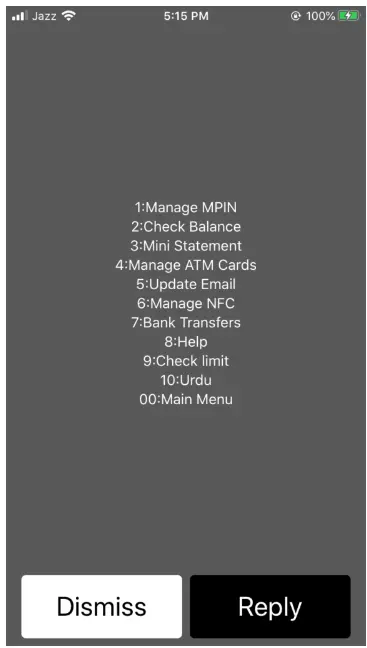

3. Set Your MPIN

- In the next step, you will set a 4-digit MPIN code for the security of your JazzCash mobile account. So, don’t share it with anyone

- Double-check it and finalize the process.

Your JazzCash account is now active, and you have full access to it. Remember that the users on other networks other than Jazz have to upload the front and back sides of their CNIC.

How to Create JazzCash Account on Zong, Telenor, and Ufone

If you are using networks other than Jazz or Warid, you can still create a digital account by verifying yourself biometrically.

Follow these steps to create your account in easy steps:

- Visit the nearest Jazz franchise or experience center or register through the JazzCash Mobile App. If you prefer to use an app for account creation, then learn “How to Create JazzCash Account in Mobile”.

- Provide your CNIC details and other required information and complete the biometric verification process.

- Your JazzCash account will be activated as soon as you are verified.

JazzCash Account Verification Online

You can easily verify your account details and update your information through its app. The account works similarly to an actual bank account but it provides its customers with added ease and benefits.

One of its benefits is JazzCash Account Verification Online. It allows customers to verify their accounts conveniently without visiting a biometric agent, franchise, or bank.

Activation of Dormant JazzCash Mobile Account

If you have a dormant JazzCash Mobile Account, you can activate it using the JazzCash App. This process takes less than five minutes and you will be able to use the app again.

- Open your JazzCash App and enter your mobile number.

- Enter the OTP sent to your mobile number and provide your full name and CNIC number.

- Scan your left hand and right hand and enter a temporary MPIN sent to your mobile number.

- Create a new 4-digit MPIN for your account and confirm it. Your account is activated.

Upgrading Your Account from L0 to L1

You can even upgrade your account from level 0 to level 1 to enhance its features and benefits.

- Open your JazzCash App and click on “My Account”.

- Select “Upgrade your account”.

- Scan your left hand and right hand.

- After scanning, your verification is successful, and you are upgraded.

By upgrading your account, you will enjoy higher transaction limits and easy cash-in or cash-out transactions at any JazzCash retailer.

- The daily withdrawal limits increase from Rs.25,000/- to Rs.200,000/- and the monthly transactional limits go up to Rs.500,000/-.

Final Words

We have written a detailed guide about creating your JazzCash account using different ways and means. Remember, JazzCash is not just an account, it gives financial freedom to you.

For more information, you can visit the official JazzCash page.